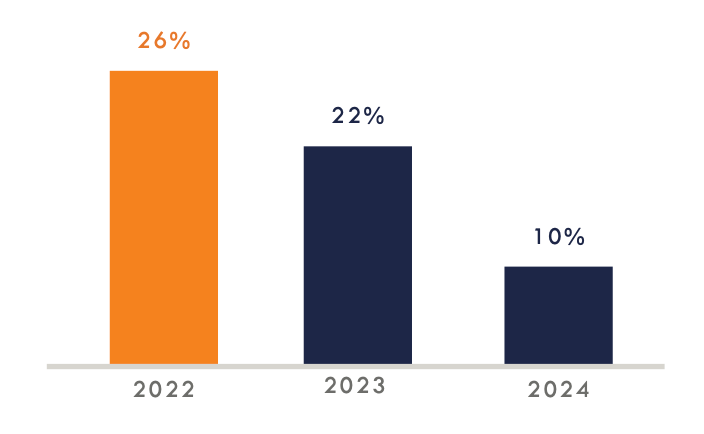

Last Year for the ITC at 26%

The Solar Investment Tax Credit (ITC) will drop from 26% to 22% next year for residential and commercial installations. The ITC was extended in 2020 and frozen at 26% for two years. This year – 2022 – is the last year to claim the 26% credit.

Here is the Solar ITC schedule:

The ITC is a dollar-for-dollar federal income tax credit for investments in solar installations. It also covers battery energy storage systems in certain applications, such as if they are installed at the same time as a solar array, or if they are being charged by the solar array. With the credit this year, federal taxes are reduced by 26% of the cost of an eligible solar installation.

The ITC significantly impacts the affordability of a solar installation. This year’s 26% credit will result in lower initial costs and better return on investment compared to lower credits in the future.

Download our 2022 guide to solar tax incentives

Build Back Better Act

You may have heard about the solar energy provisions of the now-stalled Build Back Better Act. The $2.2 trillion spending bill included $555 billion in funding for clean energy and climate change-related programs.These included:

- Restoration of both the commercial and residential ITC to 30%

- Extension of the residential ITC alongside the 10-year extension of the commercial ITC, or until U.S. greenhouse gas emissions from electricity generation fall to 25% of 2021 levels, whichever is later

- Extension of residential and commercial ITC for standalone battery energy storage systems

- Option for both residential and commercial customers to take a direct payment instead of a tax credit

- Creation of a commercial production tax credit up to $25/MWh

- Domestic solar manufacturing tax credits for panels, inverters, and active tracking systems

Although Build Back Better is considered dead by most Beltway policy watchers, there is a growing effort to pass the energy and climate portion as a standalone bill. If that effort succeeds, the resulting bill would likely contain the same provisions.

Right now it’s too early to tell if a standalone bill will pass. Build Back Better was a budget reconciliation bill. Without budget reconciliation, 60 senators need to be on board to overcome a possible filibuster. We think the budget reconciliation process will likely be used again for a standalone bill.

However, the budget reconciliation process can only be used once in a fiscal year. To improve the likelihood of passing the bill, the Senate may wait to vote until later this year before the mid-term elections.

When to Act

Because of the narrow margins in the Senate and the late-year timeframe, we think counting on a standalone clean energy bill is a risky strategy. Most people and businesses considering solar energy should operate under the assumption that the ITC will continue to step down next year. If you are considering solar energy, this is the year to act.

For additional information on the ITC, take a look at the Solar Energy Industries Association (SEIA) explanation of IRS guidance on eligibility. It’s also a good idea to consult your accountant to make sure you have enough tax liability to take advantage of the credit.

Get in touch with us to discuss your options. Our team of engineers and finance experts has experience designing systems optimized for financial performance at every scale – from residential to commercial to utility.