Converting a School into Apartments

In 2013 Todd Schneider purchased the decommissioned Fort Madison Middle School from the local school district with a plan to redevelop it as high-quality, affordable apartments. “You can’t do a building like this without funding,” Schneider said. “The amount of money you need to put into it for demolition and reconstruction, you just wouldn’t get a return.”

He applied for flood relief funding through the Iowa Economic Development Authority (IEDA). IEDA officials wanted to see sustainability in applicants’ proposals. For his School House Apartments project, Schneider and his solar energy company, Ideal Energy, developed a plan including 300 kilowatts of solar power, Iowa Green Streets-compliant plumbing fixtures, and additional insulation. Up against 66 other applicants, Schneider won $3 million in funding – a quarter of the $12 million available. Schneider believes solar power set his application apart. Solar “could be very responsible,” he said. “I believe it is.”

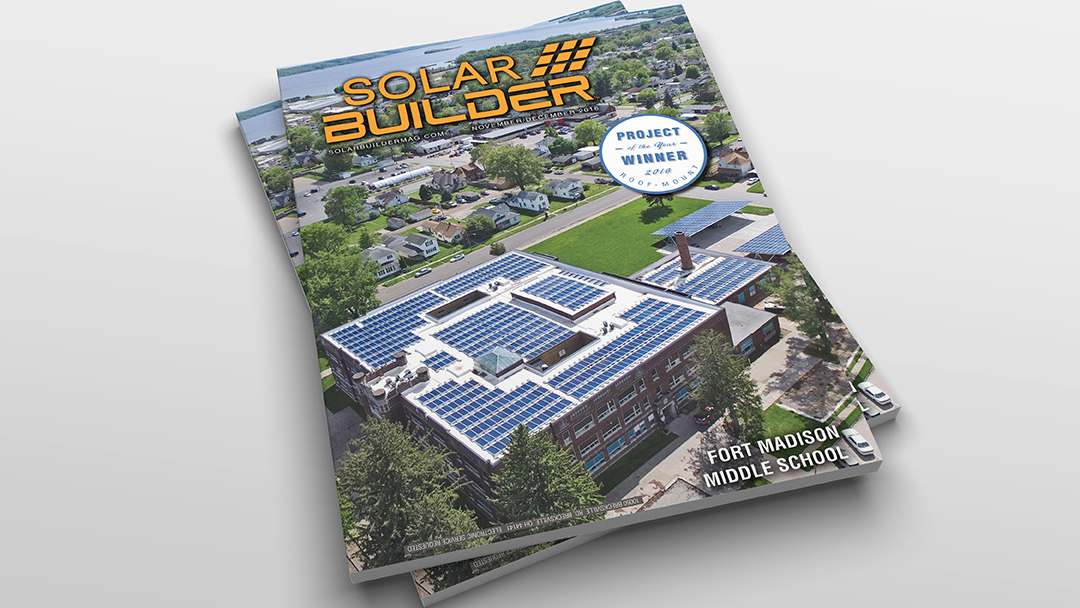

Above: School House Apartments was the recipient of Solar Builder Magazine’s 2016 Project of the Year Award

From Left to Right: At the State Capitol, Des Moines, Iowa, where the project recieved 2016 Project of the Year from 1000 Friends of Iowa in the Rennovated Residential catagory, Developer Todd Schneider

Schneider and Ideal Energy also had the insight to place each apartment unit on its own meter. This gives Schneider the flexibility to include utilities in the rent or pass on utility payments – and savings – directly to his tenants.

School House Apartments houses 39 unique units ranging in price from $600 to $1300. Within months of opening, the complex was 100% rented and profitable. It won two awards: Solar Builder‘s 2016 Project of the Year Award in the Roof-Mount category and the 1000 Friends of Iowa Best Development Award in the Renovated Residential category.

Solar for Commercial Office Rentals

While participating on a sustainability commission, developer Doug Greenfield learned that solar power was the most effective way for his city, Fairfield, Iowa to reduce its carbon footprint. The commission’s chair, who is the CEO of one of Greenfield’s anchor tenants, requested a solar array for that building. Deeming this first solar project “a complete success,” Greenfield installed arrays on several of his other office buildings in Fairfield. “The value added and the appreciation from the tenants is a real motivating force when you own commercial real estate,” he explained.

Once the array is paid for I’ll have an annuity coming in for the rest of my life and the tenants in the building will have a benefit of a discounted utility rate.”

Greenfield and his tenants both benefit from solar energy. After the arrays are paid off, he plans to offer his tenants reduced utility bills. “Once the array is paid for I’ll have an annuity coming in for the rest of my life and the tenants in the building will have a benefit of a discounted utility rate…. It’ll be a win-win in the long run.”

Greenfield used several different legal structures for his arrays, including a lease-purchase contract and a power purchasing agreement. He stressed the importance of competent guidance and accurate projections from solar energy companies. He found that with Ideal Energy. “Anyone is really in good hands with Ideal if they want to fully understand the impact of their solar array on their personal finances,” he said.

For Greenfield, solar energy is a stable investment and with a profound environmental impact. “I wish I had more buildings that needed solar,” he said. “I’d better start looking for my next building project so I can put solar on it.”

Above: Developer Doug Greenfield has used solar energy as a stratigic investment on three of his commercial office buildings.

Powerful Investments for Developers

Both Greenfield and Schneider benefited from federal tax credits, accelerated depreciation, state tax credits, and utility rebates. These programs constitute a powerful incentive package for developers.

Federal tax credits for commercial solar projects are currently 30%. Beginning in 2020 the tax credit will phase down to 10% over the course of three years. Solar equipment can be depreciated to 85% of its tax basis over five years. For projects placed in service by the end of 2017, 50% of that depreciation can be taken in the first year. This depreciation bonus will phase down over the next two years and disappear entirely for projects placed in service after 2019.

Solar arrays are cheaper than they’ve ever been. According to the National Renewable Energy Laboratory, the cost per watt of commercial-scale solar installations has decreased by 59% in the last seven years, from $5.23 to $2.13.

With the powerful incentive programs and the low cost of solar now is the perfect time for developers to consider investing in solar energy.